|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Home Refinance Company Reviews: A Comprehensive Guide for HomeownersRefinancing your home can be a strategic move for better financial management. With numerous options available, finding the best home refinance company is crucial. This guide explores the top contenders in the market, their benefits, and what you should consider when making your choice. Why Refinance Your Home?Refinancing a home involves replacing your current mortgage with a new one, usually to secure a lower interest rate or to adjust the loan term. This can lead to significant savings and financial flexibility. Benefits of Refinancing

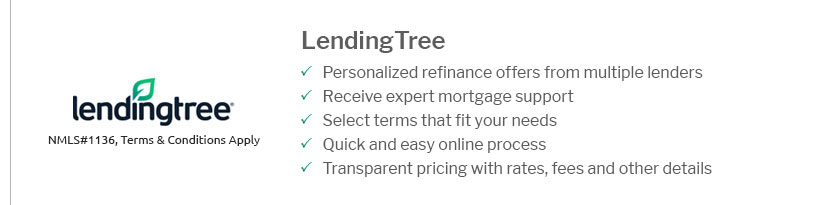

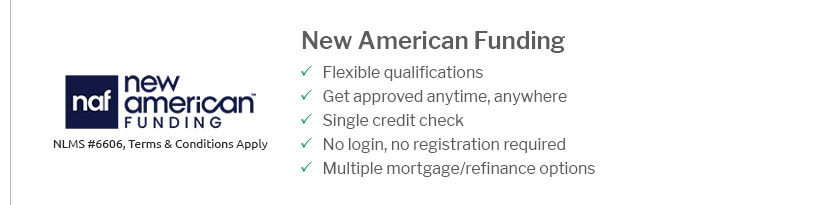

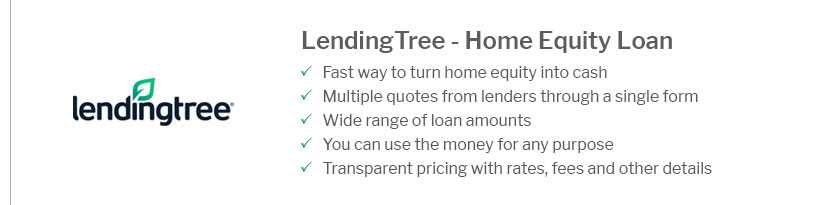

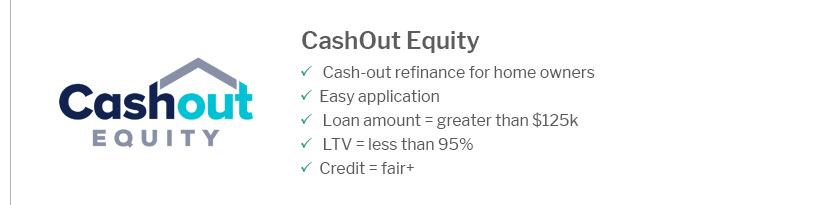

Top Companies for Home RefinanceSeveral companies stand out in the refinance market due to their customer service, competitive rates, and flexible options. Popular Choices

For those based in Texas, exploring texas refinance companies can offer localized benefits and competitive rates tailored to your region. Factors to Consider When Choosing a Refinance CompanyChoosing the right company involves evaluating several key factors to ensure you get the best deal. Interest Rates and FeesCompare interest rates and watch out for hidden fees. A lower rate can save you thousands over the life of the loan. Customer Service and SupportExcellent customer support can make the process smoother and more transparent. Look for companies with high customer satisfaction ratings. Loan OptionsEnsure the company offers a variety of loan products that suit your financial situation and goals. Consider fixed vs. adjustable rates based on your risk tolerance and financial plans. For more insights, you can explore the offerings of top refinance banks that provide diverse options and expert advice. FAQs on Home RefinancingWhat is the best time to refinance your home?The best time to refinance is when you can secure a lower interest rate, have improved your credit score, or need to change your loan terms to better fit your financial goals. How does refinancing affect your credit score?Refinancing can temporarily lower your credit score due to hard inquiries and changes in your credit history. However, timely payments on the new loan can improve your score over time. Are there any costs involved in refinancing?Yes, refinancing typically involves costs such as application fees, appraisal fees, and closing costs. It's important to calculate these against the potential savings to determine if refinancing is worthwhile. https://www.reddit.com/r/FirstTimeHomeBuyer/comments/11mjqqx/what_mortgage_lender_would_you_recommend/

Comments Section - Mortgage broker - shops the market for you with different wholesale lenders. Can get you a lower rate with Rocket Mortgage ... https://www.bankrate.com/mortgages/reviews/better-mortgage/

Better's borrower experience overall appears good, but you'll need to go elsewhere if you'd like an in-person experience. We scored the lender ... https://www.nerdwallet.com/h/reviews/mortgage-lender-reviews

Comparing mortgage lenders can help you save money on closing costs and find a better mortgage rate. Read our reviews to find the best lender for you.

|

|---|